As an e-commerce business, your merchandise is your most valuable asset. It’s also one of your riskiest investments since your profitability depends on selling off your inventory and turning it into cash — also known as turning it over. When inventory is sold faster, companies have better cash flow and face fewer risks associated with unsold stock. This makes inventory turnover one of your most important performance indicators, both for your stock management team and for your company as a whole.

Let’s talk more about this critical metric and how to calculate inventory turnover for your own business.

What Is Inventory Turnover?

Inventory turnover is a metric representing how many times a company sells and replaces its stock entirely within a given period. This ratio measures efficiency for how the company purchases and sells goods. A slow turnover rate may indicate that a company has too much stock or weak sales numbers. Low inventory turnover may also mean that products have time to expire, deteriorate or go out of season before they sell. A faster ratio may mean the company doesn’t have enough supply on hand or that sales are particularly strong.

Typically, companies calculate their inventory turnover for the fiscal year. Tracking quarterly and even monthly stock turns can also be helpful. If you’re using annual inventory turnover, a rate of 4 means the company turned over its stock four times that year. You might also hear the term “inventory turns.” This means essentially the same thing — the number represents how many inventory turns occurred within the period.

Another figure that’s similar to inventory turnover is days sales of inventory (DSI). This metric measures the average time in days it takes a company to turn its stock into sales. A lower DSI is usually preferable because it means a company can turn its inventory on hand into profits faster. You can calculate your DSI by multiplying your stock turns ratio by 365. DSI goes by many other names, including the average age of inventory, days in inventory (DII) and days inventory outstanding (DIO).

Why Is Inventory Turnover Important?

Your inventory turnover metrics can tell you a lot about your inventory management process and help you make some important strategic decisions. For example, a low turnover rate could mean two things. Either sales are down, or items are overstocked — and these concerns often overlap. If you see a low ratio, you might solve it by boosting your marketing efforts or changing your inventory. Maybe you need to stock different products or keep a smaller quantity on hand.

While low turnover may require intervention, sometimes it is advantageous. If your business expects a shortage or a sudden spike in demand that causes prices to rise, slow turnover helps you prepare for the rise in demand or to outlast the shortage. If you purchased your inventory at a low cost, you might even see higher returns as prices rise. Except in these special circumstances, a low turnover rate is something to remedy.

On the other side of the equation, high turnover is generally a sign of success. Retailers who move inventory faster compared to others in their market tend to outperform their competitors. Faster turns mean it takes less time to liquidize assets, which means less risk and less capital tied up in unsold products. Well-managed, high-turnover stock is less likely to spoil, get stolen, deteriorate or become obsolete.

High inventory turnover could also be a warning signal. It might be a sign that your purchasing and replenishment strategy is inefficient. If this is the case, you might notice other issues, such as frequent stock-outs. If your industry may face a supply shortage, or even if a supplier gets slightly delayed, a high inventory turnover rate puts you in danger of losing customers. You may need to readjust so you’re reordering in higher quantities or more frequently.

Faster inventory turns can also be a sign that goods are underpriced. While it’s sometimes necessary to sell at a discount to get rid of excess stock, your everyday sales should produce a healthy profit. When you increase your pricing to better match demand, your turnover rate will naturally go down as your profit margin goes up.

Tracking your inventory turnover yearly or quarterly can make you aware of any shifts. When you see your stock turns shoot up or drop down, you should find the cause and intervene if needed. Potential investors might also look at your stock turns to gauge your company’s efficiency compared to similar businesses in the market. Whether you’re looking for investors or not, it can be helpful to compare your turnover to your industry average or direct competitors. Striving for a sustainable turnover rate that’s faster than your competitors can help you succeed in the long term.

How to Calculate Your Inventory Turnover Ratio

You can calculate your turnover rate in two different ways. The first method takes cost of goods sold (COGS) divided by average inventory. Accountants prefer this inventory turnover formula since it accounts for the actual charges the company incurred for the products. The other method uses sales divided by average inventory. This method produces a higher ratio than using COGS. Both formulas use average inventory, which accounts for seasonal changes in stock levels.

If a company has a COGS of $15,000 and an average inventory of $5,000, then the stock turnover ratio is $15,000 divided by $5,000, or 3. If that same company uses their annual sales figures of $50,000, the inventory turn rate equals $50,000 divided by $5,000, or 10.

Cost of Goods Sold

The first number you’ll need for the inventory turnover formula and calculation is COGS. COGS is a metric that has many uses in stock control and accounting. Besides submitting this value on your tax returns, you can also use it in the inventory turnover ratio formula. COGS represents the price you paid for the products you’ve sold. It can fluctuate with your supplier’s pricing alongside shipping and handling costs. It may also incorporate your holding costs such as storage space rentals or the expenses you incur to manufacture finished products. When other costs such as shipping and handling are included in the cost of goods calculation, the COGS is commonly referred to as the landed cost.

The basic formula for COGS starts with the cost of inventory at the beginning of the year, adds in purchases and other costs, and subtracts the inventory value at the end of the year. For example, say you started with $20,000 worth of inventory. Your total cost of stock purchased plus warehousing costs was $7,000. At the end of the fiscal year, you had $18,000 worth of products. Your COGS is $20,000 plus $7,000, minus $18,000, which equals $9,000.

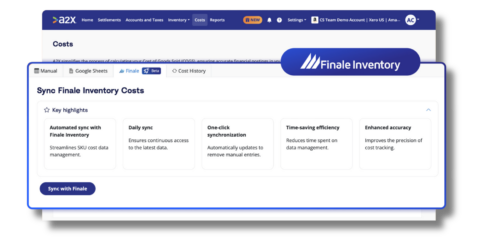

If you’re a Finale Inventory user, you can also access your COGS through our inventory accounting reports.

Average Inventory

Using the average value of stock in the inventory turnover formula accounts for seasonal changes. The simplest way to calculate average inventory is to take your beginning inventory plus your ending inventory balance and divide that figure by 2. However, if your sales and stock levels fluctuate more dramatically with the season, you may want to use a more sophisticated calculation.

You can calculate average inventory using data from every quarter or even every month if you prefer. To do this, you’ll add your previous stock plus your current stock and divide that by the number of periods you included. You could add together the stock values at the start of each month and divide them by 12 to find the year’s average inventory. Or, you could take quarterly values and divide them by 4.

Let’s say a company’s quarterly inventory values break down like this:

- First-quarter inventory value equaled $5,000.

- Second-quarter inventory value equaled $10,000.

- Third-quarter inventory value equaled $12,000.

- Fourth-quarter inventory value equaled $18,000.

To find the average inventory for the year, you’d add together all four of these figures and divide by 4. This would be $45,000 divided by 4, or $11,250.

Sales

The other way to calculate turnover is to take sales divided by average inventory. Calculating turnover using sales figures instead of COGS is less accurate because this figure includes the markup over the cost. Therefore, this calculation will inflate the turn rate and is less commonly used. If you’d like to use sales figures to calculate your stock turnover rate, you can access them from your Finale Inventory dashboard.

Days Sales of Inventory

Once you’ve calculated your inventory turnover rate, you can easily find your DSI. Take 356 and divide it by your turnover rate. For example, if your turn rate is 5, your DSI is 365 divided by 5, or 73. That means it takes 73 days for your stock to turn.

What Is Good Inventory Turnover?

While most companies strive for an inventory turnover rate between 5 and 10, there’s no hard rule. The same turn rate may be excellent for one company and too low for another.

Many factors influence acceptable stock turnover rates, and one of the most significant factors is industry. The industries that typically have the highest turnover rates are the ones that have increased sales volumes and low margins. Retail, grocery and clothing stores fit the bill and generally have higher turnover rates. Companies with high holding costs, such as automobiles or electronics, also need to maintain high turnover rates to avoid depreciation. On the other end of the spectrum with low sales volume, high margin industries have lower turnover rates.

Because turnover rates vary so much, the best way to determine a reasonable inventory turn rate for your business is to look at your closest competitors. Are other retailers or manufacturers in your market faster or slower at selling their stock? For example, in the department store industry, Nordstrom reported a turnover rate of 4.55 during 2020’s second quarter. In comparison, another popular department store, Macy’s, had a stock turnover ratio of 2.6 during the same quarter. Of these two companies, Nordstrom has a much more favorable turn rate.

If you were to compare these two department stores with Walmart’s 2020 second-quarter turnover ratio of 8.95, both would appear to be underperforming. If we look in a different industry altogether, McDonald’s second-quarter stock turn ratio of 75.08 surpasses all three companies by a landslide. It makes much more sense to compare Walmart with Target’s second-quarter 2020 turnover rate of 6.36. When we compare direct competitors, Walmart has the more efficient inventory management.

Comparing Industry Average Turnover Rates

Giving turnover numbers the right context is critical. If you cannot find statistics for your competitors, look for your industry or subsector average turnover rate for guidance. Here’s a selection of industry average stock turnover ratio data using the cost of sales, as of 2020’s fourth quarter:

- Grocery stores: As a high-volume, low-margin industry, grocery stores had an average inventory turnover rate of 16.37.

- Retail apparel: Spanning both fast fashion and luxury clothing, the industry had an average stock turn ratio of 5.84.

- Auto and truck parts: This industry saw an inventory turnover ratio of 7.38.

- Consumer electronics: As an industry selling high-cost items, consumer electronics saw an inventory turnover rate of 2.29.

- Restaurants: As an industry that must turn its inventory before food spoils, restaurants enjoyed an 11.28 inventory turnover rate.

- Recreational products: This industry includes a wide range of goods and had an average stock turn rate of 3.93.

Inventory Turnover Optimization Techniques

Most e-commerce businesses want to improve their turnover rates. While using strategies to speed up stock turns, it’s crucial to have a robust inventory management and replenishment strategy to keep up with the faster rate of turnover. A few techniques can help you manage both of these needs, including:

1. Product Bundling

Product kitting or bundling is a common inventory management technique that can boost inventory turnover. This strategy gives customers a better deal if they buy items as a set, which encourages them to buy more products. If the deal encourages enough customers to spend more money and buy more products, your turnover rate can increase. This technique is especially helpful for a retailer trying to move products before demand drops off and to prevent merchandise from becoming dead stock.

2. Marketing

Increasing your marketing improves inventory turnover by encouraging more customers to buy products. If you’re trying to get rid of a slow-moving item, you might use a special discount. However, to sustain a higher turnover rate without sacrificing profits, you’ll likely want to use promotional strategies that don’t lower your prices. Increase your marketing budget and loop in experts who can develop and execute a solid digital marketing strategy.

You might use a sophisticated upselling or product suggestion tool on your website to encourage shoppers to add more items to their cart. Or, you could place more ads on channels where your target customers are likely to see them. This strategy might also involve retargeting users who have visited your site without making a purchase.

3. Smarter Restock Forecasting

One of the best ways to optimize your inventory turnover is to restock more often in smaller quantities. This strategy requires striking the right balance because keeping a leaner inventory can cause problems if you cannot replenish in time. However, if you can predict precisely when you need to restock based on your current sales and reorder so your supplier’s lead time matches up with that date, you can hold less product with more confidence.

Finale Inventory’s sophisticated restock forecasting tool offers a fantastic solution for businesses who want to optimize their replenishment strategy. Our software can predict your future stocking needs based on many factors, including sales velocity, desired level of safety stock and supplier lead times. When using our dynamic reorder point calculations, you can set your desired days of inventory, and our software will calculate how much you need to reorder and when based on your current sales figures. This allows you to keep a tight grip over your stock turnover rate.

4. Optimize the Merchandise You Sell

Regularly review your product portfolio to determine your best-selling items. Stock more of what sells and less of what moves slowly. If you can, work out supplier discounts for products you know will have continued demand. Regularly analyze your sales by product type and by individual stock-keeping unit (SKU) to determine which items are most profitable.

Schedule a Demo to See Finale Inventory in Action

Finale Inventory is an inventory management solution that offers many tools to help you understand and improve your stock turnover ratio. Our dynamic reorder point calculations have helped many retailers keep a leaner inventory on a tighter replenishment schedule.

Our robust data and reporting tools let you track metrics to calculate your turnover rate and manage inventory accounting. For example, our landed costs calculations help you track your COGS, inclusive of your purchasing price, freight and tax. We also offer a product kitting and bundling feature that makes it easy to track quantities for individual items included in product bundles.

See how Finale Inventory can make you more efficient — sign up for a demo or register for your free trial today. Or, call our sales and support team at 888-792-8891 with any questions.